Ohio House Bill 15 Changes Ohio’s Energy Landscape - Harnessing Power of Markets to Deliver New Generation

DOWNLOAD PDF- O'Donnell, Terrence Pirik, Christine M.T. Shimp, Kevin D. Lackey, Zac F.

- Industry Alerts

Click “Subscribe Now” to get attorney insights on the latest developments in a range of services and industries.

On April 30th, 2025, the Ohio General Assembly overwhelmingly passed Substitute House Bill 151, which makes major changes to state energy policy to encourage the development of more in-state electric generation. Sponsored by Representative Roy Klopfenstein (R-Haviland), the legislation is the result of significant collaboration across chambers and party lines.

Governor DeWine is expected to sign the bill into law with an effective date 90 days later— projected to be early August.

Background

At the end of the last General Assembly, state legislative leaders signaled their plans to introduce major energy legislation in 2025. A projected potential shortfall of energy in the PJM region was a major driving force and the subject of study committee hearings.

Policymakers made clear their aim was to increase energy generation through a renewed emphasis on attracting private capital, lower taxes, a speedier siting permit process, removal of subsidies, and more “behind-the-meter” self-generation. With the exception of the state’s investor-owned utilities, most engaged stakeholders expressed support for the bill.

This bulletin summarizes HB 15’s major provisions, which:

- Reduce Tangible Personal Property Tax on all forms of new generation / storage

- Expand behind-the-meter generation opportunities

- Encourage adoption of Grid-Enhancing Technologies (“GETs”)

- Incentivize energy development on brownfields

- Require utilities to publish heat and capacity maps of the distribution system

- Institute timelines for regulatory review of generation permits and rate cases

- Establish a $40 million2 energy efficiency / solar loan program for schools

- Eliminate “Electric Security Plans” and require utilities to file rate cases every three years

- Repeal Ohio Valley Electric Corporation (“OVEC”) coal subsidies and close Solar Generation Fund

- Clarify that utilities may not own generation

- Mandate refunds for utility charges deemed unlawful by Ohio Supreme Court

Reduced Tangible Personal Property Taxation (TPPT) on Generation

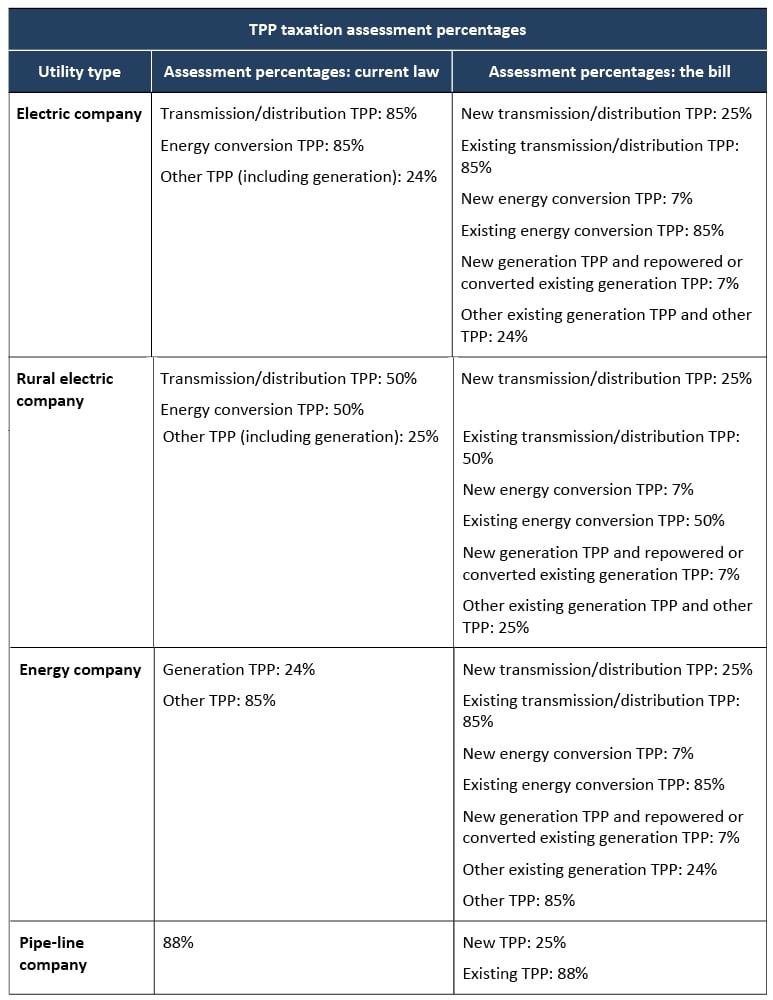

To attract increased development of generation assets in Ohio, HB 15 reduces Tangible Personal Property Tax (“TPPT”) for four types of entities as defined in the Ohio tax code.3

- Electric companies: generate, transmit, or distribute electricity and are not rural electric companies or energy companies.4 This generally includes generating facilities such as natural gas powered electric generating facilities.

- Co-ops: rural electric companies are rural electric cooperatives.5

- Energy companies: generate, transmit, or distribute electricity from a facility that has a nameplate capacity of more than 250 kilowatts and consists of wind turbines, solar panels, other renewable energy sources, clean coal, or cogeneration technology.6 The bill effectively adds energy storage systems to this definition as described below.

- Pipe-line companies: engage in transporting gas, oil, or coal derivatives.7

For these entities, House Bill 15 reduces their tax burden in the following manner:

HB 15 reduces the assessment percentage for production and energy conversion equipment of electric and energy companies from 24% to 7% (and from 25% to 7% for rural electric companies) for property first subject to property tax in or after tax year 2027. The bill reduces the assessment rate on electric transmission and distribution property as well as pipeline company property that is first subject to property tax in or after tax year 2027. As described below, the bill also exempts property that is used to transport or transmit electricity or natural gas that is placed into service within an approved Priority Investment Area ("PIA") from TPPT for five years.8

Reducing Energy Company Assessment Percentages (R.C. 5727.111): TPPT is calculated by multiplying true value of the equipment by the assessment ratio (or percentage) set forth in R.C. 5727.111. Current Ohio law has set a different assessment percentage for various parts of an energy facility. For electric companies and energy companies, the pre-HB 15 assessment ratio for production equipment (such as solar panels or gas turbines) is 24%. Other ancillary equipment like inverters and wires is classified as “energy conversion equipment” and assessed at 85%.

For new9 generation projects, HB 15 lowers the assessment percentage from 24% for production equipment and 85% percent for conversion equipment to 7% for both. Also included is existing generation property that is “converted” (if it switches fuel input from one energy source to another) or “repowered” if enough of the original production equipment is replaced such that at least 80% of the value of the equipment is derived from replacement equipment.10

Treating Energy Storage as Generation from an Energy Company (R.C. 5727.01): The legislation updates definitional terms in R.C. 5727.01 to add “energy storage” to the Ohio tax code and clarifies that energy storage systems are treated as an “energy company,” thus qualifying for the 7% assessment ratio for production and energy conversion equipment. The legislation accomplishes this tax reduction for energy storage through a series of definitional changes11:

- Defines “energy storage system” as “tangible personal property that is capable of storing and releasing energy.”12

- Adds “energy storage systems” to the definition of “energy facility.”13

- Adds “energy storage system” to the definition of “energy resource” that is applied to definition of “energy conversion equipment.”14

- Adds “store or release electricity” to definition of “energy conversion equipment” while removing “batteries” from existing definition of energy conversion equipment because batteries are classified as production equipment.15

- Revises the definition of “energy company” and “production equipment” to include “storing and releasing” and “store and release” as applicable.16

Maintaining Current Qualified Energy Project PILOT Payments (R.C. 5727.75(I)): Under existing law, qualifying renewable energy projects remit to the county a fixed annual per megawatt payment in lieu of real and personal property tax and must comply with several programmatic requirements. HB 15 essentially grandfathers those arrangements by making clear17 that existing PILOT agreements remain in effect.

Behind-the-Meter Generation

HB 15 promotes the adoption of behind-the-meter generation by large energy users and behind-the-meter service providers by:

Removing Barriers to Self-Generation (R.C. 4928.01(A)(32)): The bill relaxes existing requirements on self-generators by no longer requiring their location on generator’s premises. Instead, the legislation authorizes self-generators to host these facilities on property they own “or control,” which allows developers to site behind-the-meter generation facilities anywhere so long as the generation unit is connected to the facility consuming the power. Similarly, rather than only allowing a self-generator’s agent to install and operate a facility, the legislation enables any third party to perform these functions. HB 15 also prevents a self-generator from relying on the utility’s distribution or transmission systems to deliver its electricity.

Creating Mercantile Customer Self-Power Systems (R.C. 4928.73): HB 15 authorizes a new form of self-generation by allowing mercantile customers, defined as a commercial or industrial customer that consumes more than 700,000 kWh per year or is a part of a national account with multiple facilities18, to produce electricity for their own consumption using mercantile customer self-power systems. These self-power systems are electric generation or storage facilities that connect directly to a mercantile customer member’s side of electric meter and deliver electricity without use of an electric distribution utility’s (“EDU”) distribution or transmission systems. The bill also enables multiple mercantile customer members – and even entities that are not mercantile customer members – to own self-power systems.

House Bill 15 specifies the facilities must be on property that the mercantile customer either owns or controls, or on property that is adjacent to the mercantile customer, if the self-power facility connects directly to the customer.

Exempting Mercantile Customer Members from Certified Territory Act (R.C. 4933.81(F)):House Bill 15 exempts mercantile customer members from the Certified Territory Act (“CTA”) by specifying that retail electric service furnished to a mercantile customer member by a mercantile customer self-power system is not an electric service from a for-profit or non-profit electric supplier that must adhere to the CTA’s requirements. A similar exemption already exists for competitive retail electric service (“CRES”), which enables CRES providers to build facilities inside an electric supplier’s certified territory.

As a result of this exemption, mercantile customer self-power systems can locate within existing electric supplier territories, whether those territories belong to an investor-owned utility or non-profit electric cooperative.

Prohibiting Utility Ownership of New Behind-the-Meter Facilities (R.C. 4905.311): HB 15 generally prohibits utilities from providing behind-the-meter electric generation service. However, in recognition of current projects that may be in development or construction, the bill makes an exception if the utility has already filed an application to do so with the PUCO by March 31, 2025.

GETs and ATTs

Concern over rising demand forecasts, power outages, increasing transmission costs, and extended timelines for new service created heightened legislative interest in modernizing Ohio’s transmission system. Policymakers responded in HB 15 seeking to leverage GETs and Advanced Transmission Technologies (“ATTs”) as part of a solution. HB 15 incentivizes the deployment of ATTs by:

Defining Advanced Transmission Technologies (R.C. 4906.01): The bill defines “advanced transmission technologies” as software or hardware technologies that increase the capacity, efficiency, reliability, or safety of an existing or new electric transmission system, including grid-enhancing technologies such as dynamic line rating, advanced power flow controllers, and topology optimization; advanced conductors; and other technologies designed to reduce transmission congestion, or increase the capacity, efficiency, reliability, or safety of an existing or new electric transmission system.19 “Advanced conductor” means a conductor with a direct current electrical resistance that is at least 10% lower than existing conductors of a similar diameter on the electric transmission system while simultaneously increasing the energy carrying capacity by at least 75%.20

Requiring Transmission Planning to Include Use of ATTs (R.C. 4935.04(C)(7)): HB 15 requires owners of transmission lines with a capacity greater than 125kV to include an evaluation of potential uses of specific ATTs to safely, reliably, efficiently, and cost-effectively meet their system’s demand in their annual Long-term Forecast Report to the PUCO.

HB 15 also requires the annual report to identify locations of grid congestion, evaluate use of ATTs to address grid congestion, analyze the cost-effectiveness of installing ATTs to alleviate grid congestion, and propose an implementation plan for installing ATTs to maximize transmission system capacity.

Creating PUCO Study on Advanced Transmission Technologies (Uncodified; Section 7): By March 1st, 2026, HB 15 requires the PUCO to complete a study on potential uses of ATTs. The study must:

- Evaluate attributes and benefits of various ATTs

- Evaluate potential for deployment of each ATT by public utilities to provide safe, reliable, and affordable electric utility service

- Identify potential reductions in project costs and completion timelines due to deployment of ATTs

- Evaluate potential methods to streamline deployment of ATTs, including permitting reforms

- Compare the policies and laws of other states that encourage adoption of ATTs

- Identify how PUCO can support the implementation of ATTs

- Identify opportunities for the Federal Energy Advocate to support implementation of ATTs at PJM and FERC

In conducting the study, the PUCO must hold at least two workshops to take public comment.

Mandating Consideration of Advanced Transmission Technologies in Siting Process (R.C. 4906.06 & R.C. 4906.10): Transmission line applications to the PUCO must now include a summary of studies “of cost-effective advanced transmission technologies that maximize the value, expand the capacity, or improve the reliability of the facility.”21 The legislation imposes a corresponding requirement on the Ohio Power Siting Board (“OPSB”) to make a determination that the facility must consider implementing cost-effective advanced transmission technologies to maximize the value, expand capacity, or improve the reliability of the facility in order to grant a certificate for a transmission line application.22

Ohio Power Siting Board Procedural Changes & Decision Deadlines

OPSB Decisions Required within 150 Days of Completeness (R.C. 4906.10(D): Responding to the heightened demand for prompt access to additional generation, HB 15 shortens statutory procedural times for standard OPSB application cases and requires the OPSB to issue a decision on whether to grant a certificate of environmental compatibility and public need not later than 150 days after an application is deemed complete. If the OPSB does not render a decision within the 150-day period, the application is deemed approved.

Standard Certificate Application Review Timelines Shortened:

- Completeness Determination within 45 days of Filing (R.C. 4906.06(G): Requires OPSB to determine whether an application is complete not more than 45 days after filing (current rule is 60 days).23

- Public Hearing Deadline (R.C. 4906.07(A)): Reduces the timeline when the OPSB is required to hold a public hearing on an application to between 45 days and 60 days after an application is found to be complete (current law is 60 to 90 days).

Accelerated Review for PIA Projects (R.C. 4906.03(G)): Requires OPSB to adopt rules regarding the accelerated review of electric generation facility, transmission line, and gas pipeline applications if projects are in a PIA as described below. Under this new section, the OPSB must make a completeness determination within 45 days of application submission and then issue a decision within 45 days. The OPSB must adopt rules that prioritize applications in areas negatively impacted by the decline of the coal industry.

Accelerated Review when No Additional Consent Required (R.C. 4906.03(H)): Requires OPSB to adopt rules regarding the accelerated review of a major utility facility located on (1) property owned by, or under a lease with a term of 25 years or more with the applicant, (2) an easement or right-of-way, or (3) a combination thereof, if no additional consent for the construction on the property, easement or right-of-way is required by any person or entity other than the OPSB. Under this new section, the OPSB is required to issue a decision not later than 60 days of application submission. If the OPSB does not render a decision within 60 days, the application will be considered approved by operation of law, and the OPSB shall issue a certificate to the applicant.

Utility Ratemaking Reforms

HB 15 deliberations noted that the state’s utilities have not filed ratemaking applications on a regular cadence. Instead, many have utilized more narrow proceedings known as Electric Security Plans (“ESPs”) to establish new bill charges (“riders”) to accommodate specific functions. The bill reforms the utility ratemaking process in several important ways:

Repealing ESP Statute (R.C. 4928.143): HB 15 repeals the statute authorizing ESPs while allowing the continuation of existing ESPs through the final Standard Service Offering (“SSO”) auction delivery period.

Requiring Rate Cases Every 3 Years (R.C. 4909.181): HB 15 requires utilities to file a ratemaking application by December 31st, 2029 and every 3 years thereafter.

Prohibiting Settlement Inducements (R.C. 4905.331): In some PUCO proceedings, utilities have offered financial incentives to intervening parties to facilitate settlement. HB 15 bans this practice. It also prohibits utilities from making cash payments or entering into private arrangements that are not on a proceeding’s public docket as a settlement inducement.

Authorizing Customer Rebates for Unlawful Utility Charges (R.C. 4905.321): A decades-old Ohio Supreme Court decision (“Keko24”), citing a prohibition on retroactive ratemaking, barred customer rebates for PUCO-approved charges later found to be unlawful. HB 15 reverses this policy and subjects to refund all revenues collected by a public utility from date of the Ohio Supreme Court’s decision finding the charge improper through the date the PUCO modifies that charge. The bill also requires the PUCO to order refunds within 30 days of the Court’s decision.

Setting Statutory Deadlines for PUCO Decisions (R.C. 4904.19 & R.C. 4909.421): Public utilities and others cited “regulatory lag” as a challenge to doing business in Ohio. HB 15 requires the PUCO to issue staff reports within 180 days of determining a ratemaking application is complete25 and an order approving, denying, or modifying a ratemaking application within 360 days of determining an application is complete.

Additionally, the bill allows a utility to request a temporary increase in rates and parties to the application to request a temporary decrease in rates 275 days after an application’s filing, which is the date the PUCO determines an application is complete.26 Similarly, the bill prohibits new discovery in a ratemaking proceeding 215 days after application is deemed complete.

Expanding Authorized Programs & Charges in Ratemaking Applications (R.C. 4909.192 & R.C. 4928.05): HB 15 authorizes the PUCO to approve the following programs and rates:

- Programs available to all energy intensive customers that promote economic development and enhance grid reliability via job growth, job retention, and interruptible rates proposed by a utility.27

- Programs that bill CRES customers directly for transmission service or rates for mercantile customers that align with how utilities incur transmission costs.28

- Non-bypassable cost recovery mechanism for transmission, congestion, or ancillary service for costs utilities incur pursuant to their SSO.29

Strengthening Deregulation

In 1999, Ohio deregulated the state’s energy market with the enactment of Senate Bill 3. This reform allowed customers the opportunity to select their electric generation supplier and introduced a more market-based approach to generation.

As lawmakers debated how to incentivize new generation last year, some members of the General Assembly suggested Ohio’s public utilities should build new generation facilities and recover their costs in rates. However, HB 15 took a different approach. Reliance on market principles to address potential generation shortfalls is a key theme of the bill, as seen in the following provisions:

Expressly Prohibiting Utilities from Owning Generation (R.C. 4928.01(A)(6)): HB 15 specifies that utilities cannot own or operate electric generation facilities. This ban is meant to act as a signal to independent power producers that they need not compete with public utilities who can rate base generation.

Prohibiting Utilities from Acting as CRES Providers (R.C. 4928.041): HB 15 prevents utilities from providing CRES if the service is already deemed a competitive service at the bill’s effective date. CRES in Ohio allows suppliers to purchase wholesale quantities of power from independent power producers to sell to residents and businesses. These suppliers compete against each other in the marketplace seeking to offer the best available pricing and other favorable terms like renewable-only generation. Similarly, HB 15 prevents EDUs from participating in the wholesale market with an energy storage system used for distribution service.

Mandating Competitively Bid & Market-Rate SSO’s (R.C. 4928.142): Pre-HB 15, Ohio law allowed utilities the option to competitively bid their SSO and establish it as a “Market-Rate Offer,” or MRO. HB 15 removes this discretion and instead requires competitively-bid MROs. As a result, a utility’s standard rate under an SSO will be set using a competitive solicitation process with clear product definitions, standardized bid evaluation criteria, and independent 3rd party oversight.

Brownfield Development: Priority Investment Areas

HB 15 fosters the re-development of former coal mines30 and brownfields31 by allowing for PIAs as designated by the Ohio Department of Development. Cities, townships, or counties may request the designation on former coal mines and brownfields.32 In a PIA, all property dedicated to “transporting or transmitting electricity or natural gas within these areas” is exempt from TPPT for five years33 and eligible for expedited treatment from the OPSB34 as described above. PIA projects are also eligible for $10 million in grant funding from the state’s existing Brownfield Remediation Program.35

School Energy Performance Contracting Loan Fund (R.C. 3313.377 & R.C. 3313.378)

The bill establishes a new program to help school districts cover the cost of energy efficiency upgrades. Through the School Energy Performance Contracting Loan Fund, school districts (including joint vocational school districts) can receive loans from the Ohio Facilities Construction Commission to pay for installing or implementing energy conservation and energy saving measures.36 Loan proceeds can go toward installation of a variety of products including insulation, energy efficient windows, HVAC replacements, automatic energy control systems, and solar panels.

The maximum loan term is ten years at an interest rate of 2%.37 Funding for the program is estimated to be approximately $40 million and comes from excess dollars in the existing Solar Generation Fund after eligible utility-scale solar projects are funded.38

Base Load Generation Facilities (R.C. 4905.23)

HB 15 prohibits any person from entering into a settlement agreement to close a base load generation facility. These facilities, as newly defined, are generation plants owned and operated by an entity other than a public utility, electric cooperative, or city that use non-renewable fuel sources, including natural gas and nuclear power.

Repeal of OVEC Subsidy (Uncodified; Section 4) and the Solar Generation Fund (Uncodified; Section 5)

House Bill 6 from the 133rd General Assembly authorized select utilities to collect a “legacy generation resource” rider for the costs associated with owning and operating the two OVEC coal plants. The subsidy was scheduled to expire on December 31, 2030 (though some costs were deferred). The same bill established a Solar Generation Fund for three qualifying Ohio utility-scale solar projects, which could earn revenue for production through 2026.

HB 15 eliminates both of these programs. For OVEC, the legislation eliminates the rider upon its effective date. Solar Generation Fund collections will also cease, but the projects will be made whole through a lump sum payment equal to their projected generation (through 2026) based upon the net present value of those expected revenues.

Distribution of Heat Maps (R.C. 4928.86) and Hosting Capacity Maps (R.C. 4928.83)

House Bill 15 requires utilities to post distribution system hosting capacity maps on their websites by May 31, 2026. The utility must update these maps quarterly, and the maps must show total available distribution hosting capacity, hosting capacity availability for distributed energy resources, geographic locations and voltage level of circuits and substations, and available substation and circuit capacity. Additionally, the PUCO must hold at least two annual stakeholder meetings to receive input on the map’s design, accuracy, and usability.

Similarly, the legislation requires entities that own or control transmission facilities other than PJM and municipal-owned electric utilities to create “heat maps” that include the additional capacity of each major transmission line and substation as well as the amount of localized generation each transmission line can host. It also requires the entities to post these maps on their websites so long as the map does not contain information on critical infrastructure.

Linear Generation

In support of linear generation technology, a newly developed energy conversion technology that has the potential to efficiently deliver cost-effective on-site energy utilizing a variety of fuel sources, House Bill 15 creates a definition of “linear generation.” The legislation defines these systems as an integrated system consisting of oscillators, cylinders, and electricity conversion equipment that (1) converts linear motion of oscillators directly into electricity without a flame, (2) is dispatchable with the ability to vary power output across all loads, and (3) can operate on multiple fuel types, including renewable fuels.3

Conclusion

Several items that passed one chamber or the other were not included in the final version of HB 15. They include “community energy” to allow for a subscription model for smaller-scale local energy projects and a residential demand response program.

Key legislators have indicated HB 15 will not be the only energy bill undertaken during the 136th General Assembly. We expect advocates will continue to pursue the above initiatives (as well as others) before legislative session concludes at the end of 2026.

This alert was prepared by Terrence O’Donnell, Christine M.T. Pirik, Matt McDonnell, Kevin Shimp, and Zac Lackey.

1 Ohio Senate vote of 33-0; Ohio House of Representatives vote of 94-2 (Stephens, Jones)

2 Estimated

3 R.C. Chapter 5727 et seq.

4 R.C. 5727.01(D)(3)

5 R.C. 5727. 01C))

6 R.C. 5727. 01 (D)(10)

7 R.C. 5727. 01 (D)(5)

8 R.C. 5727.76. The exemption begins for the tax year after the tangible personal property is placed into service and applies for five total years.

9 R.C. 5727.111(H)(3). HB 15 amends section 5727.111 by setting the assessment percentage at 7% in the case of an energy company’s “taxable production or energy conversion equipment first subject to taxation in this state for tax year 2027 and thereafter or any other taxable production equipment that is either converted or repowered.” Further, section 8 of the bill specifies that the amendment by this act to R.C. 5727.01 and 5727.111 applies to tax year 2027 and every tax year thereafter. HB 15 provides that an energy company’s assessment rates are one of the following:

- Eighty-five percent in the case of its taxable transmission and distribution property first subject to taxation in this state before tax year 2027;

- Twenty-five percent in the case of its other taxable transmission and distribution property;

- Seven percent in the case of its taxable production or energy conversion equipment first subject to taxation in this state for tax year 2027 and thereafter or any other taxable production equipment that is either converted or repowered;

- Twenty-four percent in the case of its other taxable production equipment; or

- Eighty-five percent in the case of all its other taxable property.

10 As used in R.C. 5727.111, "convert" means to switch fuel input from one energy source to another and "repower" means to replace enough of the original taxable production equipment to make an original production facility equivalent to a new facility, such that at least eighty percent of the true value of the taxable production equipment is derived from new taxable production equipment installed as part of the replacement project.

11 See R.C. 5727.01

12 R.C. 5727.01(R).

13 R.C. 5727.01(P).

14 R.C. 5727.01(N).

15 R.C. 5727.01(O).

16 R.C. 5727.01(D)(10) and R.C. 5727.01(J).

17 R.C. 5727.75(I)

18 R.C. 4928.01(A)(19).

19 R.C. 4906.01(M).

20 R.C. 4906.01(N)

21 R.C. 4906.06(A)(7)

22 R.C. 4906.10(A)(4)

23 See Ohio Adm.Code 4906-3-06(A)

24 Keco Industries, Inc. v. Cincinnati & Suburban Bell, 141 N.E. 2d 465 (1957).

25 R.C. 4904.19(C)

26 R.C. 4909.193(B)

27 R.C. 4909.192(A)

28 R.C. 4909.192(B)

29 R.C. 4928.05(B)(1)

30 R.C. 122.161(A)(5); "Former coal mine" means a location that was, but is no longer, used in connection with the extraction of coal from its natural deposit in the earth.

31 R.C. 122.6511(A)(1); "Brownfield" means an abandoned, idled, or under-used industrial, commercial, or institutional property where expansion or redevelopment is complicated by known or potential releases of hazardous substances or petroleum.

32 R.C. 122.161(B)

33 Id. ; R.C. 5727.76

34 R.C. 4906.03(G)

35 R.C. 122.6511(B)

36 R.C. 3313.377

37 Id.

38 R.C. 3313.378

39 R.C. 4928.01(A)(43)

Related Practices

Contacts

Recent Insights

- Industry Alerts Ohio Extends Clean Energy “Payment in Lieu of Tax” Program for Four Additional Years: Legislature Adds Flexibility on In-State Workforce Requirement

- Industry Alerts Ohio Supreme Court Unanimously Affirms Siting Board Certificate for New Wind Farm - Emerson Creek Project in Huron and Erie Counties Now Expected to Move to Construction

- Industry Alerts Ohio Legislature Passes Biennial Budget; Governor DeWine Approves Historic Investments in Public Education and School Choice

- September 15, 2025 Industry Alerts Key D.C. Circuit Decision Revives CAA Emergency Event Affirmative Defense

- April 18, 2025 Industry Alerts Federal Agencies Ordered to Streamline Infrastructure Permits

- April 09, 2025 Industry Alerts Supreme Court Limits EPA's Power Over NPDES Water Permits

- January 8, 2025 In the News Rachel Bolt Joins Dickinson Wright Denver Office

- January 06, 2025 In the News Metals Recycling Magazine recently published Kyle Girouard's article, "Recycling Without Regret: Leveraging SREA to Protect Your Business."

- November 21, 2024 In the News Five Dickinson Wright Attorneys Recognized in 2024 Mid-South Super Lawyers